Harmony in Acquisition: Mastering Decentralization, ROI, and Valuation Insights

In today's fast-paced business landscape, mastering the art of acquisition has become essential for organizations aiming for sustainable growth and competitive advantage. As companies look to expand their portfolios, the challenge lies not only in identifying potential targets but also in integrating these acquisitions seamlessly into the existing corporate structure. This is particularly crucial in a decentralized organization, where local decision-making must be aligned with overarching corporate strategies. Achieving harmony in this complex ecosystem requires a strong emphasis on information sharing, education, and compensation structures that incentivize local leaders to act in the company’s best interests.

Understanding financial metrics such as return on equity is vital for decision-makers in private companies as they navigate the intricacies of acquisition valuations. The conventional use of EBITDA multiples can offer insights, but it also carries inherent flaws that can mislead assessments if not approached with a critical eye. By fostering a culture that values strategic acquisitions while ensuring that local managers are equipped with the necessary tools and knowledge, organizations can enhance their ability to make informed decisions. This article will explore these interconnected themes, offering insights into how companies can turn acquisitions into a core strength while maintaining operational coherence across their decentralized networks.

Integrating Acquisitions into Core Strategy

In today’s competitive business environment, making acquisitions a core element of an organization’s growth strategy is essential. Companies that view acquisitions as a strategic tool rather than just a financial transaction can leverage them to enhance market position, diversify product offerings, and increase operational efficiencies. By integrating acquisitions into the core strategy, organizations can align these initiatives with their long-term goals, ensuring that every acquisition serves a purpose and contributes to overall success.

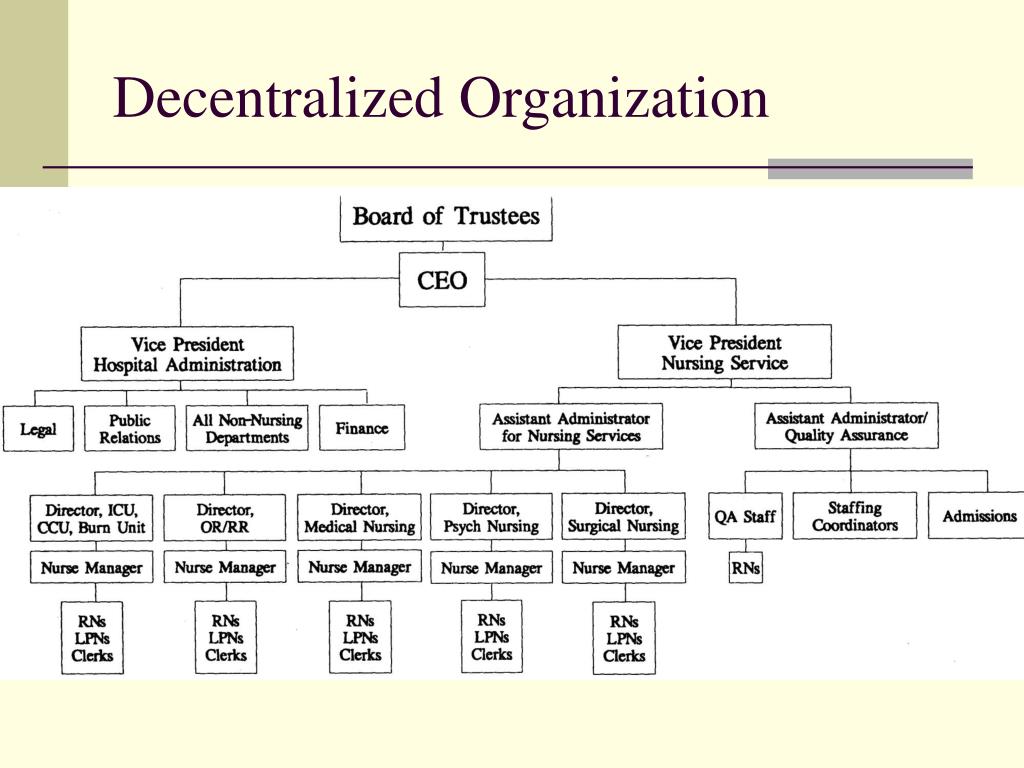

To effectively integrate acquisitions, decision-making processes must be decentralized, allowing local teams to act swiftly and decisively based on their unique market insights. Empowering local decision-makers encourages innovative approaches tailored to their specific environments. However, this requires a robust framework of information flow and educational support to ensure that teams understand the larger organizational objectives and metrics for evaluating potential acquisitions. This harmonious approach ensures that local initiatives align with the company's vision while fostering a sense of ownership and accountability among teams.

Finally, the success of integrating acquisitions into core strategy hinges on a clear understanding of return on equity and the valuation measures that underpin acquisition decisions. Private companies often face challenges in assessing true value, making it vital to look beyond traditional financial metrics. By considering the broader implications of acquisitions on equity and utilizing comprehensive valuation approaches, organizations can make informed decisions that enhance their market position while ensuring that each acquisition bolsters their financial health in the long run.

Decentralization and Local Decision-Making

Decentralization plays a pivotal role in enabling organizations to thrive in dynamic environments. By empowering local managers with decision-making authority, businesses can respond more swiftly to market changes and customer needs. This local empowerment not only allows for quicker adjustments but also fosters a sense of ownership among employees, leading to higher levels of engagement and motivation. When managers in different regions or departments are trusted to make decisions, they are more likely to devise innovative solutions that resonate with their specific audience.

Effective local decision-making hinges on the availability of relevant information and education. Organizations must invest in robust information systems that provide managers with timely data and insights, enabling them to make informed choices. Additionally, training programs that educate employees on the organization’s strategic goals and performance metrics ensure that decisions are aligned with the broader company vision. This interconnectedness between local action and central strategy creates a cohesive operational framework that maximizes efficiency and effectiveness.

Compensation structures also play a crucial role in supporting decentralized decision-making. When financial incentives are aligned with local performance outcomes, managers are motivated to seek initiatives that drive value and profitability in their specific areas. A well-structured compensation system enhances accountability, encouraging local leaders to take calculated risks while ensuring that their choices contribute positively to the organization's overall objectives. By harmonizing local decision-making with information, education, and compensation, companies can unlock the full potential of decentralization.

The Role of Information and Education

In a decentralized organization, information plays a pivotal role in ensuring that local decision makers can align their strategies with the overall goals of the company. Effective communication channels must be established, allowing for the seamless flow of relevant data throughout the organization. By empowering teams with accurate information, they can make informed decisions that reflect both local market conditions and the broader objectives of the company. This linkage between local insight and centralized strategy fosters a cohesive approach to acquisitions and overall business management.

Education is equally vital in this ecosystem. Providing continuous training and development opportunities ensures that all employees understand the principles of acquisitions, the implications of financial metrics, and the overall vision of the organization. When staff are well-versed in these areas, they become more capable of contributing to strategic discussions and executing decisions that positively impact return on equity. As a result, the organization not only fosters a culture of knowledge but also enhances its ability to pursue successful acquisitions that align with its long-term vision.

Moreover, linking information and education with compensation structures can further motivate local decision makers. By integrating performance metrics that highlight the outcomes of informed local decisions, organizations can create an environment that encourages accountability and innovation. When employees see a direct correlation between their knowledge, the decisions they make, and the rewards they receive, they are more likely to engage deeply in the acquisition process and contribute to the overall success of the organization. This harmony between information, education, and compensation ultimately strengthens the organization's capacity to thrive in a decentralized framework.

Compensation Structures for Decentralized Teams

In decentralized organizations, crafting effective compensation structures is essential for encouraging local decision-making. When teams operate independently, aligning their goals with the overall vision of the company can be challenging. A well-designed compensation model should reward employees based on local performance metrics that reflect their contributions while still connecting to broader organizational objectives. This balance ensures that teams feel empowered to make decisions while remaining aligned with the company's strategic goals.

Moreover, incorporating educational components into compensation structures can enhance understanding and engagement among team members. Providing training on how compensation relates to company performance can motivate employees to not only achieve personal targets but also to understand their impact on the organization as a whole. This approach fosters a culture of transparency and accountability, where employees feel a direct connection between their efforts, compensation, and the success of the organization.

Finally, it's important to consider the role of bonuses and incentives in decentralized settings. Incentives should be tailored to local circumstances, allowing teams to take risks and innovate without the fear of financial repercussions. Offering bonuses based on both team and individual achievements can encourage collaboration while still recognizing individual efforts. By designing compensation structures that reflect these principles, organizations can create a harmonious environment where decentralized teams thrive and contribute effectively to the organization's overall success.

Understanding Return on Equity in Private Firms

Return on equity, or ROE, is a fundamental metric for assessing the profitability and efficiency of a company in generating returns for its shareholders. In private firms, where financial metrics can be less transparent than in publicly traded companies, understanding ROE is crucial for both investors and management. It gives insight into how well a private firm is using its equity to generate profits, allowing stakeholders to evaluate performance over time or against industry peers.

For private companies, calculating ROE involves net income divided by shareholders' equity. However, nuances arise in interpretation, given that private firms might have distinct equity structures or varying profit retention strategies. Investors should consider the context of the firm’s operations, market stability, and growth projections when analyzing ROE. This approach not only aids in making informed investment decisions but also helps management identify areas for improvement in profitability and capital utilization.

Furthermore, comparing ROE among private firms can be challenging due to differing accounting practices and reporting standards. Therefore, it is essential to adjust financial metrics to ensure a fair evaluation. Investors should also focus on trends in ROE over time, as consistent improvement can signal effective management and strategic foresight. Ultimately, mastering the understanding of ROE equips stakeholders with the knowledge to navigate the complexities of private firm investments and drives better decision-making in acquisition strategies.

Evaluating Acquisition Valuations

When assessing acquisition valuations, it is crucial to recognize the prevalent use of EBITDA multiples as a valuation tool. EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortization, provides a snapshot of a company's operational performance and profitability. By comparing the company in question to similar businesses within the industry, acquirers can derive a fair multiple that attempts to reflect its market value. However, relying solely on EBITDA multiples can often lead to superficial assessments that overlook the nuances and complexities of the business being evaluated.

One of the main flaws of utilizing EBITDA multiples is the potential for misrepresentation of a company's financial health. Different companies may have varying capital structures, operational efficiencies, and growth prospects, making direct comparisons challenging. Additionally, an EBITDA-focused analysis can mask underlying issues such as high debt levels or unsustainable revenue streams, which might not be apparent until further investigation is conducted. Therefore, while EBITDA multiples can offer valuable insights, they should not be the sole determinant in the valuation process.

Despite these limitations, EBITDA multiples do offer certain benefits. They provide a standardized method for valuation, useful for quick comparisons across similar firms. This simplicity can speed up the acquisition process and allow stakeholders to make decisions efficiently. Furthermore, when used alongside other valuation methods—such as discounted cash flow analysis or asset-based valuations—EBITDA multiples can enhance overall understanding of a target company's worth, leading to more informed acquisition decisions. Balancing these approaches is essential for a comprehensive valuation that reflects both immediate operational performance and long-term potential.

Balancing EBITDA Multiples: Flaws and Benefits

EBITDA multiples serve as a common valuation metric in acquisitions, providing a straightforward indicator of a company's profitability relative to its enterprise value. They offer a quick and clear way for acquirers to assess whether they are paying a reasonable price based on earnings potential. However, reliance on EBITDA multiples can be flawed due to their variation across different industries and market conditions. This inconsistency can lead to misinterpretations of a company's true value, particularly if investors overlook other important financial indicators or industry-specific nuances.

One significant benefit of using EBITDA multiples lies in their ability to normalize earnings by removing the effects of financing and accounting decisions. This allows acquirers to focus on operational performance without the noise created by capital structure and tax implications. Additionally, EBITDA provides a snapshot of a company's cash generation capabilities, which is crucial for evaluating potential returns. When used in conjunction with other valuation techniques, EBITDA multiples can create a well-rounded picture of a company's financial health and acquisition feasibility.

Nevertheless, it is essential for companies to approach EBITDA multiples with caution. While they can offer insights, these multiples do not account for factors such as market trends, future growth potential, and qualitative aspects like management effectiveness or customer loyalty. By understanding both the strengths and limitations of EBITDA multiples, organizations can make informed decisions during the acquisition process, ensuring that they achieve a harmonious balance between valuation accuracy and strategic investment goals.