Navigating Financial Leadership: A CFO's Blueprint for Success in the Healthcare and Biotechnology Sectors

In today's rapidly evolving healthcare and biotechnology sectors, the role of the Chief Financial Officer has transformed into a crucial pillar of organizational success. As the landscape becomes increasingly complex, with challenges such as risk management, acquisition integration, and dynamic business planning, a CFO's ability to navigate these waters is essential. For leaders in finance, possessing a strong educational foundation, such as an MBA from the Kelley School of Business at Indiana University, provides a robust framework for understanding the nuances of financial management in a healthcare context.

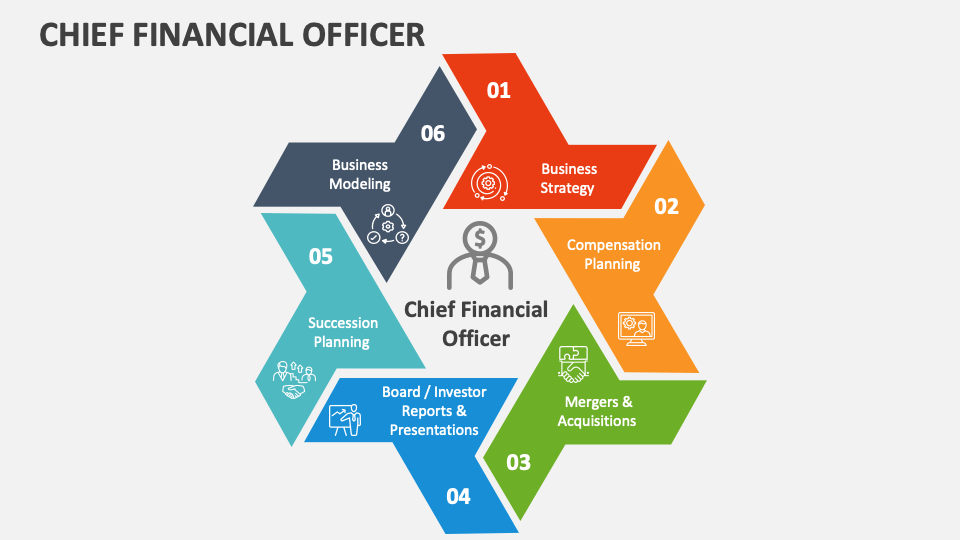

At the heart of effective financial leadership lies the ability to foster relationships built on mutual respect, trust, and collaboration. CFOs must not only excel in traditional financial operations but also engage proactively with the board of directors, aligning business strategies that drive productivity improvement and cost reduction. Whether overseeing institutions like OakBend Medical Center or guiding companies in biotechnology, such as those working on cellular immunotherapies for cancer treatment, the emphasis on operational efficiency and sound financial practices remains paramount. In this article, we will explore key success principles that can empower CFOs to lead with confidence and vision in these vital industries.

The Role of the CFO in Healthcare

The Chief Financial Officer, or CFO, plays a pivotal role in the healthcare sector, balancing the demands of financial management with the unique challenges of delivering quality care. As the industry grapples with regulatory changes, increasing operational costs, and evolving technologies, the CFO is at the forefront of strategic decision-making. Effective risk management and acquisition integration are essential, as CFOs navigate mergers and partnerships that can enhance service delivery and improve patient outcomes.

In addition to overseeing traditional financial operations, the CFO in healthcare is deeply involved in business planning and development. This involves not only budgeting and forecasting but also identifying new revenue streams that align with the organization's mission. Whether it’s exploring funding opportunities for innovative cellular immunotherapies or enhancing existing cancer treatment programs, the CFO must work closely with other executives to ensure that financial strategies support the overall business strategy.

Relationship building is a key aspect of the CFO's role as well. By fostering mutual respect among team members and maintaining open lines of communication with the board of directors, the CFO can drive initiatives that lead to productivity improvements and cost reductions. Trust is essential when leading finance operations, particularly in a sector where transparency and accountability are paramount. Ultimately, the success principles established by the CFO not only influence financial health but also impact the organization’s ability to deliver exceptional care to patients.

Strategic Risk Management

In the rapidly evolving healthcare and biotechnology sectors, strategic risk management is vital for a Chief Financial Officer. A robust risk management framework enables CFOs to identify, assess, and mitigate financial and operational risks that could hinder business objectives. This involves monitoring regulatory changes, shifts in market dynamics, and emerging technologies that could impact financial stability. By proactively addressing these risks, the CFO not only protects the organization but also positions it to seize new opportunities for growth.

Collaboration with cross-functional teams is essential in developing an effective risk management strategy. The CFO should work closely with legal, compliance, and operational leaders to ensure that all potential risks are considered from multiple perspectives. This integrated approach fosters a culture of transparency and accountability within the organization, which is crucial for maintaining trust among stakeholders, including the board of directors. Engaging in regular risk assessments and scenario planning can help the CFO to anticipate challenges and devise contingency plans that align with overall business strategy.

Learn More from Jeffrey Hammel

In addition to traditional risk factors, CFOs in healthcare and biotechnology must also account for specific industry challenges, such as the complexities of acquisition integration and the nuances of financing research and development projects. Continuous training in financial management, auditing, and controllership can enhance the CFO's ability to navigate these intricate landscapes. By fostering relationships based on mutual respect and prioritizing operational efficiency, CFOs can drive productivity improvement and cost reduction initiatives that ultimately enhance the organization’s resilience against potential risks.

Acquisition Integration Best Practices

Learn More from Jeffrey Hammel

Successful acquisition integration is crucial for realizing the expected synergies and financial benefits from a merger or acquisition. A cornerstone of this process is the establishment of a clear integration strategy that aligns with the overall business goals. This involves thorough due diligence prior to the acquisition, where potential risks are mapped, operational efficiencies assessed, and cultural compatibility evaluated to ensure a smooth transition. Engaging stakeholders early on—including the board of directors and key management—facilitates buy-in and paves the way for effective collaboration during the integration phase.

Communication plays a pivotal role in acquisition integration. It is essential to maintain transparency and provide regular updates to all employees, as well as relevant external stakeholders. This fosters an environment of mutual respect and trust, reducing uncertainty and anxiety about the changes. Leadership should prioritize team building across the newly combined organization to promote a cohesive culture, enabling both entities to leverage their strengths and create a unified direction. Establishing feedback loops allows for ongoing adjustments based on employee input, further reinforcing a commitment to listening and continuous improvement.

Finally, measuring the success of the acquisition integration should be grounded in both qualitative and quantitative metrics. Tracking operational efficiency gains, cost reductions, and productivity improvements provides concrete evidence of the integration's impact. Regularly revisiting the integration strategy and adapting it based on performance outcomes ensures that the organization remains agile and can capitalize on emerging opportunities. Effective financial management during this phase not only secures approval from boards and stakeholders but also reinforces the CFO's role as a strategic leader within the healthcare and biotechnology sectors.

Enhancing Operational Efficiency

Operational efficiency is a cornerstone of success for a CFO in the healthcare and biotechnology sectors. In these fast-paced industries, optimizing processes and resource allocation is vital for maintaining competitive advantage. A CFO must analyze existing workflows and identify bottlenecks that hinder productivity. Implementing advanced financial management systems can streamline operations, allowing for better tracking of expenses and improved budget adherence. This analysis should be continuous, employing metrics that measure effectiveness and contribute to the overarching business strategy.

Furthermore, a CFO must prioritize the integration of risk management practices within operational frameworks. This involves assessing potential risks associated with new initiatives and ensuring that operational plans align with corporate objectives. By developing robust risk mitigation strategies, a CFO can protect financial health while enabling innovation. This balanced approach fosters a culture of operational excellence that encourages teams to deliver quality outcomes without compromising compliance or financial integrity.

Finally, fostering a culture of mutual respect and trust among teams is essential for enhancing operational efficiency. A CFO should invest in relationship building across departments, encouraging collaboration and open communication. By recognizing the contributions of all team members and promoting teamwork, organizations can improve morale and drive productivity. Establishing clear channels for feedback and engaging in team-building activities can also lead to more effective finance operations, ultimately enhancing the overall performance of the company.

Financial Management Essentials

Effective financial management is crucial for the success of CFOs operating within the healthcare and biotechnology sectors. A solid grasp of key financial principles allows leaders to navigate the complexities of business planning and development. This involves implementing robust budgeting processes, accurate forecasting, and thorough risk management strategies that cater specifically to the nuances of these industries. Through diligent financial oversight, CFOs can ensure that their organizations are not only compliant with regulations but also poised for sustainable growth.

Learn More from Jeffrey Hammel

An essential aspect of financial management is the ability to integrate acquisition strategies seamlessly. This involves evaluating potential targets, understanding their financial health, and aligning them with the organization's broader business strategy. Once an acquisition is complete, effective integration hinges on careful financial oversight, ensuring that resources are allocated efficiently and that productivity improvements are realized. This attention to detail not only enhances operational efficiency but also supports long-term debt management and cost reduction initiatives.

Learn More from Jeffrey Hammel

CFOs must also prioritize relationship building, both internally and externally. Establishing trust and mutual respect with the board of directors and other stakeholders fosters a collaborative environment that drives strategic decision-making. By cultivating strong connections, CFOs can facilitate discussions around financial goals and objectives, enabling the organization to adapt to evolving market demands. Ultimately, the principles of success in financial management leverage teamwork and communication to enhance overall organizational performance in the competitive healthcare and biotechnology landscape.

Cultivating Leadership and Team Dynamics

Effective leadership in the healthcare and biotechnology sectors requires a deep commitment to fostering an environment of collaboration and trust. A CFO must prioritize relationship building with their team and across the organization, understanding that mutual respect is foundational to achieving high performance. By emphasizing open communication, leaders can ensure that team members feel valued and empowered to contribute their ideas and expertise.

In addition to nurturing a positive team culture, a successful CFO must focus on productivity improvement and operational efficiency. This involves not only streamlining financial operations but also encouraging innovation and adaptability within the team. By implementing structured business planning and risk management strategies, leaders can equip their teams to navigate the complexities of the healthcare landscape while staying aligned with the overall business strategy.

Finally, effective team dynamics hinge on the principles of respect and trust. A CFO should lead by example, demonstrating integrity and transparency in all dealings. This approach fosters an atmosphere where team members are more inclined to take ownership of their responsibilities and collaborate to drive the organization forward. By prioritizing team building and emphasizing shared goals, CFOs can create a resilient and agile organization capable of thriving in the ever-evolving healthcare and biotechnology sectors.

Principles for Sustainable Growth

Learn More from Jeffrey Hammel

Sustainable growth in the healthcare and biotechnology sectors hinges on strategic risk management and acquisition integration. A CFO must assess potential risks meticulously, understanding the dynamic regulatory environments and market fluctuations unique to these industries. By implementing robust risk management frameworks, CFOs can not only safeguard the organization’s assets but also position it for successful mergers and acquisitions. This thoughtful integration process ensures that new assets align with the company’s long-term strategic goals while enhancing operational capabilities.

Another core principle is effective business planning that incorporates financial foresight and adaptability. The healthcare industry is characterized by rapid innovations and shifting patient needs, making it imperative for CFOs to adopt flexible business strategies that can respond to change. Business development initiatives should focus on cultivating partnerships that foster innovation, particularly in areas like cellular immunotherapies and cancer treatment. This proactive approach to business planning not only drives growth but also aligns resources efficiently to enhance overall productivity.

Lastly, the foundation for sustainable growth lies in strong leadership and relationship building. A CFO must cultivate an environment of mutual respect and trust within corporate operations, promoting transparency across all levels of the organization. By fostering collaboration and open communication, CFOs can motivate teams and optimize finance operations. This commitment to nurturing relationships not only enhances team building but also drives cost reduction and improves financial management, ultimately steering the organization toward long-term success.